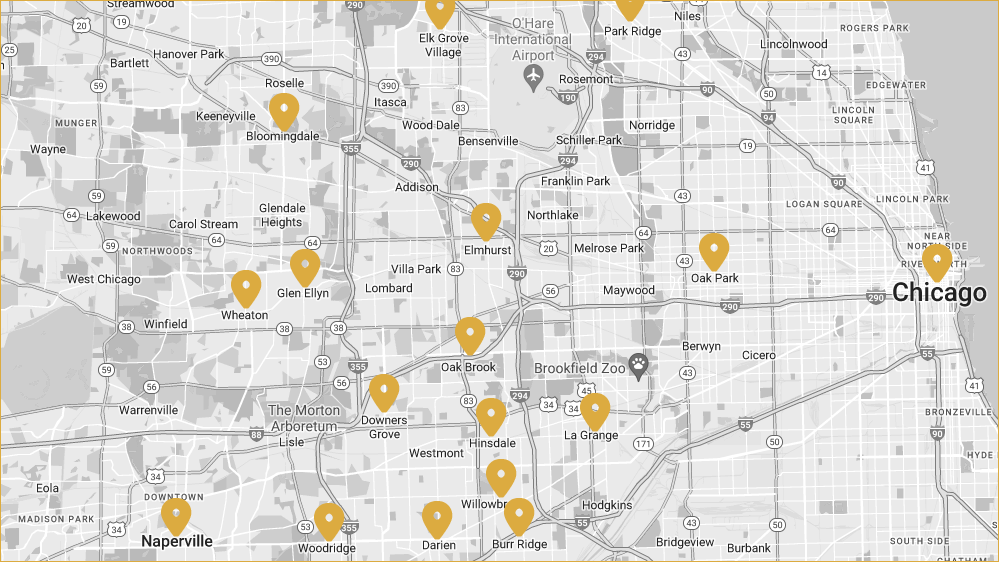

Do you ever look around your home and find yourself thinking, “I love this place, but I really wish I could update this or change the layout of that room”? We understand that feeling. If you answered Yes, it might be time to consider a home renovation. If you’re ready to take on that kitchen transformation in Arlington Heights or that bathroom renovation in Naperville but you’re not sure how to finance the project, we’ve got the answers.

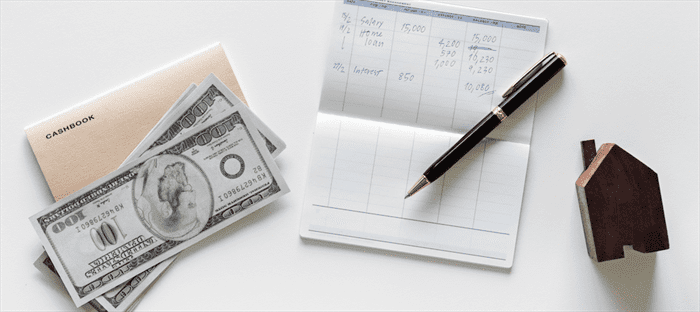

Pay Outright

While this might not be available to everyone, one way to pay for your home renovation or home addition is with cash. If it’s possible, you can pay the design and build team up front or you can work out a payment plan to pay off the project in installments while the work progresses.

Get a Loan

Another opportunity for home renovation financing exists in the form of a personal loan. Applicants for personal loans put some cash down as a down payment and get a line of credit for the rest. If you choose this route, be sure to run your credit first to make sure you can get approved, and compare options so you can get the most reasonable interest rate.

Refinance Your Mortgage

Since mortgages are long-term payment plans, you might have the choice to take advantage of a cash-out refinance. This new loan will replace your current mortgage and provide you with the funds you need for your bathroom remodel, basement renovation, or other project. Your monthly payments with a refi will likely be lower than if you take out a personal loan, but you will have to pay higher closing costs and the refinance restarts the clock on your mortgage.

Use Your Home’s Equity

If you’ve lived in your home for a while, you can look into taking out a home equity loan or a home equity line of credit. A home equity loan is a second mortgage. They typically have a fixed interest rate and you get the money in one lump sum. You usually have to pay back the loan within 15 years, so this can be a good choice for projects with a set price. The other option is an equity line of credit, which is similar to opening a credit card. This is a good decision if you’re spacing out projects over a couple of years and don’t need the lump sum all at once. These also must be paid back within 10 to 15 years, on average, and they have adjustable mortgage rates.

Find Out What Your Project Will Cost

If you’re ready to get an estimate on your home renovation or you want to learn more about how to pay for a remodel, reach out to the LaMantia team in Hinsdale. We’re happy to help, and we offer complimentary consultations.