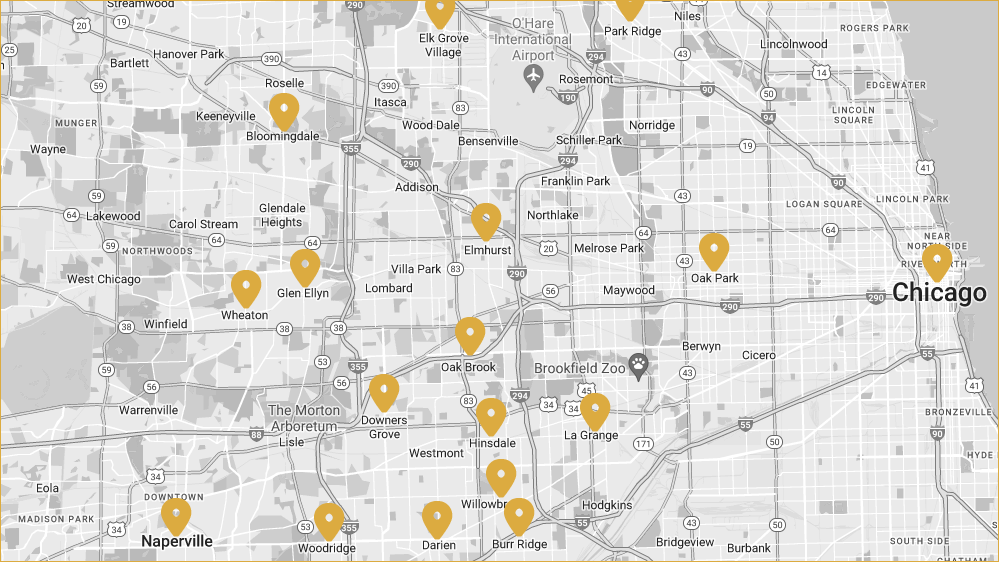

When you’re looking at buying a home, sometimes you get lucky and find a turnkey property, with everything already updated and a style that matches your own. Other homes, however, require a little more TLC. Whether you’re taking on a total fixer upper in Elmhurst or you want to make a few minor updates to your house in Hinsdale, the first question you need answered is, “How do I renovate a home I just bought?”

Be realistic from the start.

Before even purchasing a home, determine how much of a project you can realistically take on. If you’re handy, you might be able to deal with some home renovations yourself to save money. But for larger projects, like kitchen transformations and new bathroom designs, you’ll need to figure out how to fund them to ensure you’re not getting in over your head.

Take some time.

Once you find your future home, it’s tempting to dive right in and start tackling projects immediately. But it’s better to take some time to create a home remodeling plan. Of course, some projects need to be completed sooner for comfort or safety reasons. If the floor is damaged, there’s mold, or the plumbing is damaged, those need to be addressed before moving in (or immediately after). Other, more cosmetic projects, however, can wait. Give yourself some time to live in the home for a bit to see where it needs the most attention.

Make a game plan.

Once you’ve given yourself some breathing room, you’ve likely created a long list of home renovation to–dos that might include finishing the basement, updating the exterior color, installing new floors, renovating the kitchen, updating the bathroom, or even adding on an addition. The next step is to put your projects in order in terms of importance and cost. You might also want to consider what will increase the resale value if you plan on moving in a few years

Consider your budget.

As we mentioned, the best place to start is by considering both your short-term and long-term home renovation budgets. Will you have money set aside for these projects or do you need to take out a loan? How much time will you need in between each project to pay it off before starting something new? In some cases, first-time homebuyers can get an FHA loan that allows for remodeling, but there’s a monetary limit. You might also be able to take out a personal loan, or opt to wait until you’ve built up some home equity.

Work with professionals.

While you may be able to complete some DIY projects, other more involved remodels and renovations should be left to professionals. Consider working with a design and build company in the Chicagoland area, because they serve as your one, local point of contact throughout the entire process, making it as easy and stress-free for you as possible.